CTA CRM will keep your data away from the government until the last possible moment... If a lawsuit prevails, your filing fee will be applied to marketing services. 10% of every filing will be allocated to fighting the legislation with lawsuits.

CTA CRM - BOIR Compliance Assistance

Providing Corporate Transparency Act (CTA) Compliance for Your Business...

• U.S. Based in Utah.

• We Keep Your Information Secure.

• Inexpensive and Done Right.

Your business may be subject to the new Treasury Department Corporate Transparency Act (CTA).

We will determine what you need to do and will get you fully compliant: quickly, safely, and inexpensively!

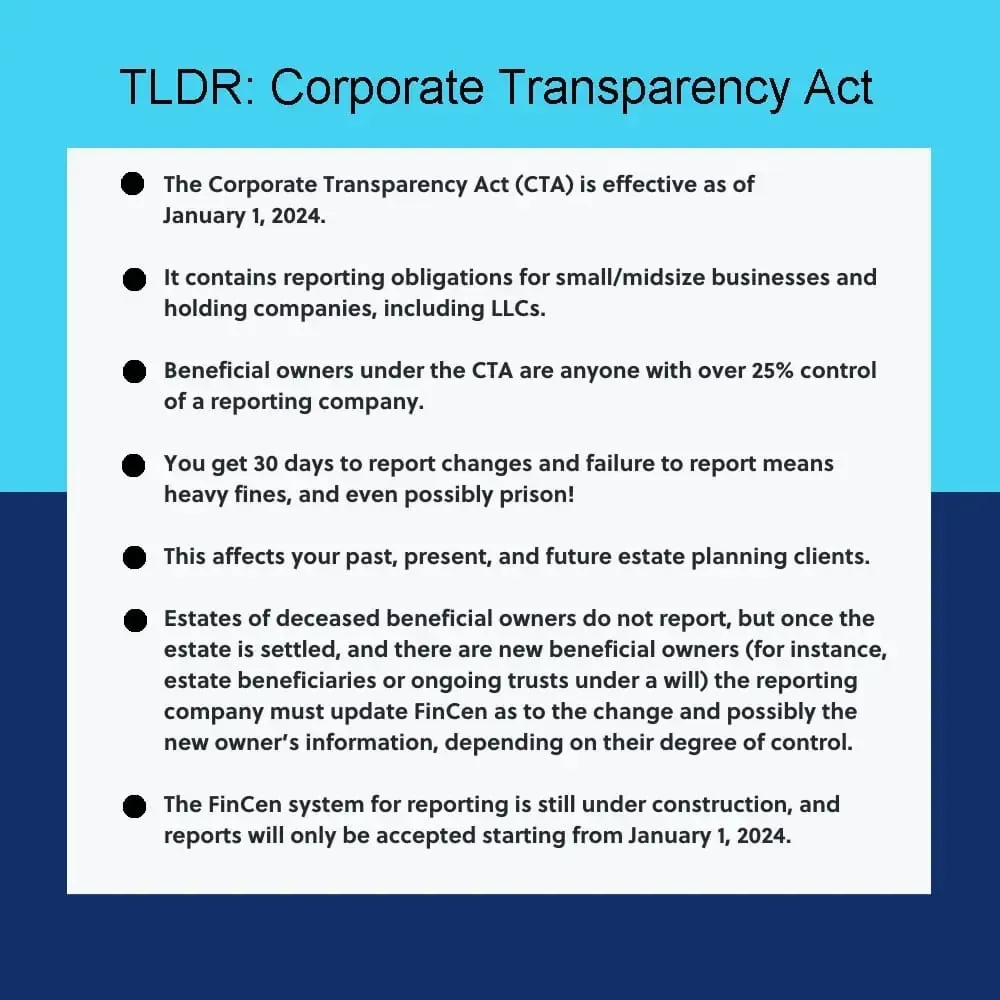

TLDR - Too Long, Didn't Read...

The CTA is a new regulatory act which goes into effect January 1, 2024.

Your business will most likely be required to report to FinCEN, the Financial Crimes Enforcement Network, a bureau of the Treasury Department.

The final rule published by FinCEN is a 99 page PDF document.

DEPARTMENT OF THE TREASURY

Financial Crimes Enforcement Network

31 CFR Part 1010 RIN 1506–AB49

Beneficial Ownership Information Reporting Requirements

AGENCY: Financial Crimes Enforcement Network (FinCEN), Treasury.

ACTION: Final rule.

Please review it, you'll discover why we say "TLDR: Too Long Didn't Read..."

About Us

Our goal is to help small business owners become compliant, avoid fees and possible prosecution required by FinCEN.

We offer our services to tax preparation entities, law firms, financial institutions and financial planners as well as individuals. We do not offer legal advice as to the advisability of filing or not filing. We do prepare and provide online compliance assistance. (Please see our Terms of Service below.)

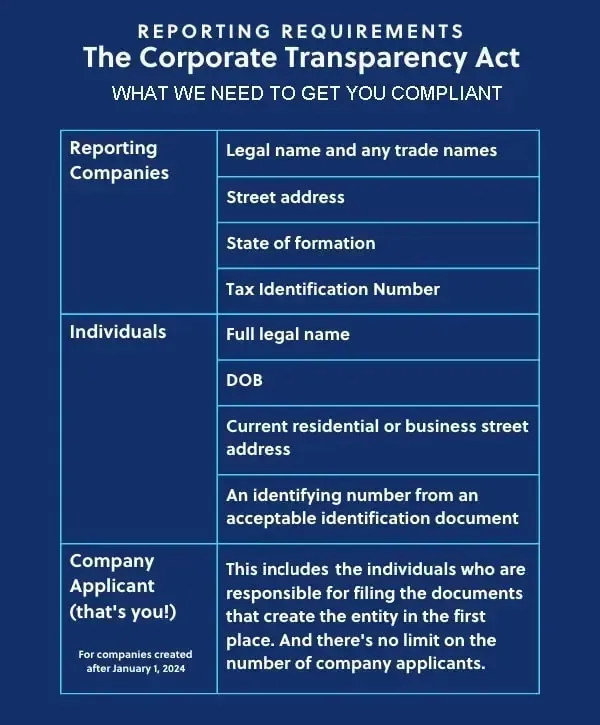

Filing Data Requirements

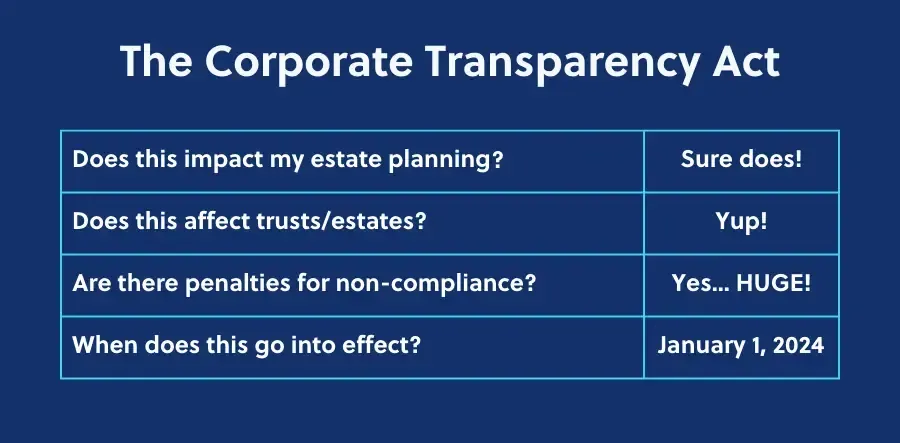

How does the CTA affect you and your business?

The Corporate Transparency Act (CTA)

The act goes into effect on January 1, 2024, and requires certain companies to report “beneficial owners” and people with substantial control of the business.

FinCEN, Financial Crimes Enforcement Network

FinCEN is a bureau of the Treasury Department. Penalties for non-compliance will result in fines of $500/day up to a maximum of $10,000 for each violation.

CTA CRM - Your Solution for Peace of Mind

You’ll have peace of mind knowing that you are in compliance, and that your personal data stays here in the U.S. on secure servers.

Simple Pricing

Individual Entity Filing

$299

New Entities before Jan. 1, 2025

Basic Compliance - Single Entities

Done with You!

*CTA CRM will keep your data away from the government until the last possible moment... If a lawsuit prevails, your filing fee will be applied to marketing services. 10% of every filing will be allocated to fighting the legislation with lawsuits.

Immediate

Delivery

Interested In Becoming An Affiliate? Join our Affiliate Program!

Click the link below and submit the required information to apply for an Affiliate Account.

Once approved, you’ll receive your unique affiliate link to share with your clients to earn a $50 referral fee for any completed CTA application and filing.

We hope you’ll take advantage of this offer while it lasts. Spaces are limited!